I have to admit, many of these articles I write end up being about not listening to the news. This isn't me declaring "fake news" when seeing opinions I disagree with. These articles are filled with interesting information about investment markets. The problem is this information is seldom useful for making actual investment decisions.

As you can guess, I have already started writing about the same topic. I was spurred to do so by something that made me laugh this morning. I was checking on the S&P 500 index to see how markets were doing. After seeing the index was flat for the day, I clicked on Google's news tab to see what the headlines were saying. Scrolling down, I saw the following headlines in a row.

In case you aren't familiar, Jim Cramer is an ex hedge fund manager who currently hosts Mad Money. On this show he tells investors which stocks to buy and which to sell. He is probably the most recognisable market pundit on television.

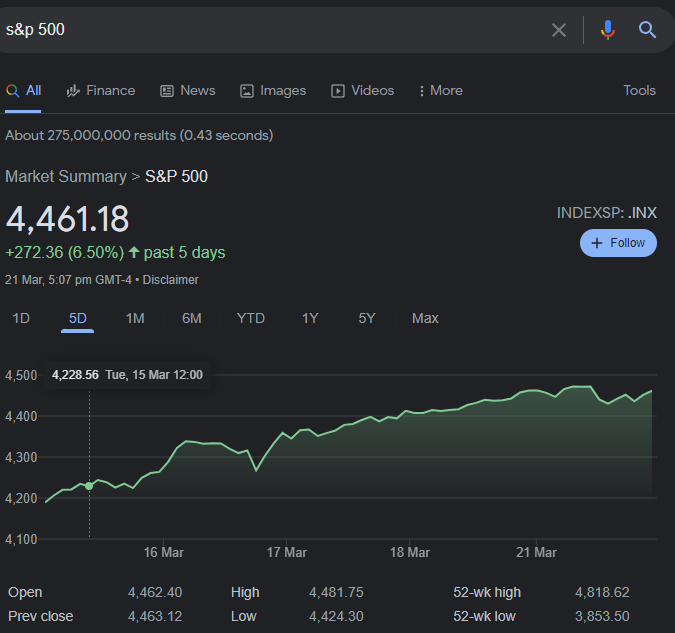

The article was from five days ago. The headline has Cramer suggesting the US share market would be falling for days. Clicking back to the S&P 500 chart and choosing "5D" as the timeframe, here is what I saw.

The market shot up 6.5%, over a pretty consistent 5 days! I couldn't help but chuckle, especially noticing the article just beneath Cramer's was titled "Stock Pickers Watched the S&P 500 Pass Them by Again in 2021". I wonder why?

Unfortunately, investors heeding Cramer's advice would again be watching the index pass them by. It will be suprising to many how listening to the most recognisable market commentator ended up burning them like this.

However, looking at the index from the start of the year, it is understandable why some investors may worry.

At the time this article was released, the market was down 13% since the start of the year. It is during times like this, when markets are down and the financial news is gloomy, that even experienced investors can get nervous. You cannot look into future to check who has it right.

But history has shown that those who try to time the market or pick stocks do worse on average than the patient, disciplined, long-term investors. This is demonstrated again by the article under Cramer's.

The other important thing to note is how important keeping the right perspective is for investing. One of the most common cognitive biases for investors is recency bias, where investors react more strongly to recent events than older ones.

I understand why many people would be concerned looking at the red graph above. With all the talk of Ukraine, inflation, interest rates etc., who wouldn't be worried?

But over the last two previous years we fought a global pandemic while stock markets surged. Here is the S&P 500 graph stretched out to 12 months.

A 13.1% return is very good for shares. And this 12 months includes the period this year when US shares were down 13%!

I do not doubt that if these 12 months started with a drop of 13% and then powered ahead to where we are now, investors would be much more confident moving forward. It is recency bias which convinces us that the two situations are different, despite the outcomes being the same.

Of course, investors should always consider long-term outcomes. Here is the S&P 500 over 5 years.

The takeaways are clear. First off, even experienced market commentators don't know where the market is headed. While financial news may be interesting, there is no information in these articles that is not already included in market prices.

Articles written during times of uncertainty are not only more frequent, but also more likely to illicit an emotional response. It is important to keep a cool head before making investment decisions, which is difficult when bombarded with scary headlines.

Lastly, a long-term perspective shows, despite ups and downs, markets reward disciplined investors over time. Recency bias leads investors to place too much importance on recent market movements. For many, this influences their decision-making and leads to poorer returns over time.

With long-term investing, cooler heads will prevail. Try not to worry about what commentators are saying about where markets are headed. Instead remain focused on your own goals and a long-term perspective